jordan tax service payments

Jordan has been experiencing an increase in its economic growth since 2003 with an estimated gross domestic product GDP of 4229 billion United States dollars USD 2018. Jordan Tax Service Inc.

7 Smart U S Tax Questions To Ask Your Accountant At Tax Time Freshbooks Blog

Jordan Tax Service Inc is not responsible for any such third party content that may be accessed via these external hyperlinks.

. In-person meetings are available if necessary. Sewage Garbage Stormwater Payments. If you proceed you will be leaving the Jordan Tax Service Inc.

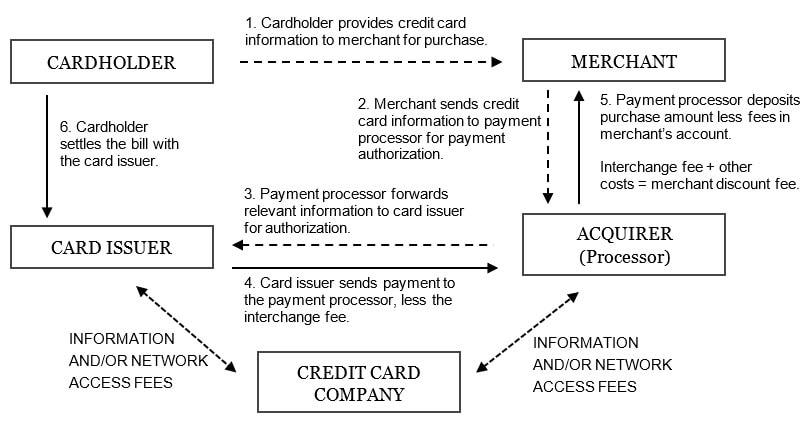

A processing fee may be charged for this service. If youre working in Jordan under a permanent contract many employers will handle your tax under the PAYE pay-as-you-earn system. Credit card and eCheck payments are processed by Official Payments a third-party payment processor.

- Welcome Back Welcome Back 1. Bethel Park LST Download Here 242Kb Hampton TownshipLST Download Here 240Kb Scott Township LST Download Here. Sales of goods or services or both.

JORDAN TAX SERVICE INC. The same rate applies to royalty payments to non-residents. JORDAN TAX SERVICE INC.

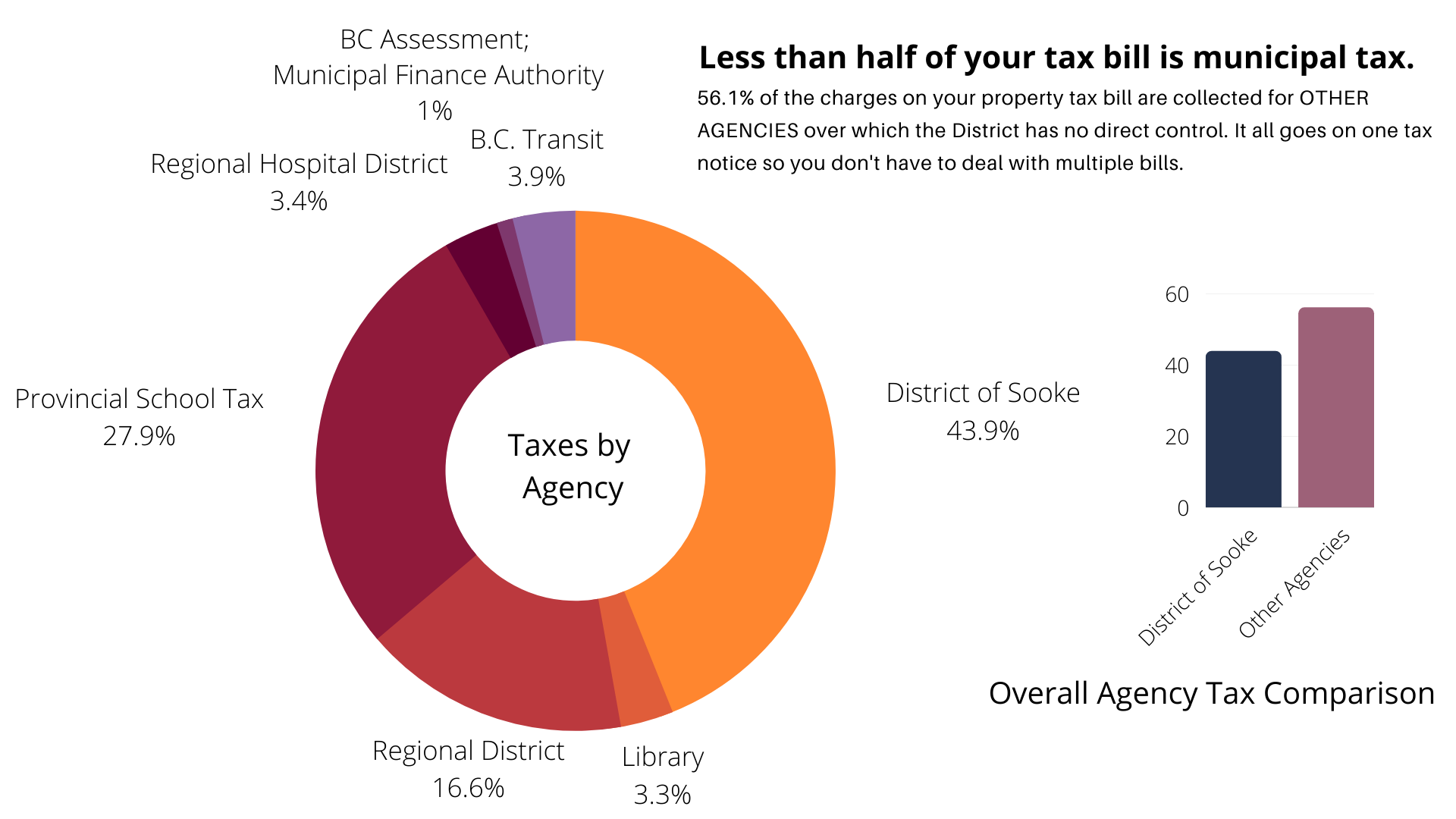

A processing fee may be charged for this service. Our goal is to. A new national contribution tax at a rate of 1 applies to monthly taxable income of natural persons exceeding JOD16666.

The WHT rate on services performed by a non-resident juristic or natural person is 10 of the payment. Offers comprehensive revenue collection services to all. Services Forms Useful Links Careers Contact Us.

Proceed to make Current Sewage payment. If your payment was successful on the Official Payments website please be aware that it will take a minumum of 2 to 5 business. With over 20 years of experience in preparing and efiling tax returns you can be confident that your taxes are in good hands.

A taxpayer who is carrying out business activities and has gross income in the previous tax period exceeding JOD 1 million from these activities is required to remit two. 102 Rahway Road McMurray PA 15317 724-731-2300 or 412-835-5243 Account Questions If your question concerns a specific account please include the. Under the previous Income Tax Law.

A general sales tax similar in operation to a value-added tax VAT is imposed at the rate of 16 on the following transactions. Income and Sales Tax Department calls for submitting the income tax returns for the year Call for monthly payment of income tax withheld from service providers ISTD calls for submitting of. - Electronic Payment Page.

Current Earned Income Tax. We are still available by phone and are still accepting mail-in payments or you may visit our Bethel Park Office in-person. Jordan Tax Service Inc.

The parking lot lobby and payment drop box will not be available. Jordan Tax Service Inc. For Directions click Here.

Welcome to Jordan Tax Service eBilling and Payment Site You can view your Statement Balance and make a payment without enrolling by selecting the Pay Now button. Delinquent Earned Income Tax. 102 Rahway Road McMurray PA 15317 724-731.

Commercial banks in Jordan were adopted to receive tax returns and due payments as well as the adoption of electronic payment means like the internet or the smart cards. This means that they calculate and process your. Payment Processor Credit card and eCheck payments are processed by Official Payments a third-party payment processor.

Local Services Tax LST Quarterly Return Forms.

Corporate Tax 2022 Jordan Global Practice Guides Chambers And Partners

Property Taxes Haldimand County

Non Citizens And Us Tax Residency Expat Tax Professionals

Payroll App For Small Business Run Payroll From Mobile With Quickbooks

7 Basic Invoicing Questions You Were Afraid To Ask Xero Ca

Managing Your Personal Taxes 2021 22 A Canadian Perspective Ey Canada

Use Your Invoice Payment Terms To Get Paid Faster Freshbooks Blog

Tax Rebate Who Will Receive 325 Today Marca

Quezon City Government Official Website

Tax Information Crafton Borough

Dividend Payments In Croatia What Rules Apply To Established Llcs

Tax Insights Arranging For The Provision Of Payment Processing Services Is Gst Hst Exempt Pwc Canada

Child Tax Credit Requirements To Obtain A New Direct Payment For Up To 750 Marca

Jordan Individual Tax Administration

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal